When I first started up as a freelance sound designer and re-recording mixer, I had never been responsible for running a business. Working for myself seemed to be the ultimate job; I could set my hours, pick my projects, and do things how I wanted to do them. Beyond this freedom, what else was there? As it turns out, I completely glossed over that whole “how to run my own business” thing, charging headlong into freelancing with no real understanding of what that entailed. Had I taken just a few moments to sit down and read a bit about being your own boss and business, I would have saved myself a whole lot of trouble down the road. Here are a few of the bigger things I learned along the way; hopefully, you can learn something from my mistakes.

Agreements and Contracts

First and foremost: I am not a lawyer, nor do I present myself as one or play one on TV. I am someone who learned (often the hard way) the importance of working with a written agreement or contract. Everything had seemed simple enough; a client would bring me onto a project, I would provide my services, then get paid once the work was completed. Having only ever worked with close friends on smaller, low/no budget projects this had never been an issue. However, as I started working with people I didn’t know on bigger-budget projects that could run for longer periods of time, it became clear that having things like project scope, timelines, number of revisions, payment, and terms written down before work starts, even in something as simple an email, was a necessity.

When everyone involved in a project is on the same page, things run far more smoothly. I found myself feeling less stressed when I knew when to expect turnovers, when deliveries would happen, and when I would be getting paid. As the projects got larger and more complex, so too would the agreements, providing more details of what was expected of how to deal with things like the inevitable overage. I’ve spoken to a lot of other freelancers about their contracts, especially when dealing with overages, and everyone agrees that having everything spelled out in a contract not only make their lives easier, but can put the client at ease; no one, especially clients, likes surprises when it comes to how much something costs. While this seems like a no-brainer now, it was something I somehow missed at first and paid the price.

Getting Paid

Having only really ever been a normal employee and gotten a regular paycheck, the entire way that payments worked from the business side of things was completely foreign to me. I had never put together an invoice and was completely unfamiliar with how the entire process worked, especially when it came to the “terms” part of the payment details. It had never occurred to me that I would provide a client with an invoice, and then some period of time later, they would write me a check; I had always assumed that I would just get paid on delivery by default. When, on my first paid freelance gig, this didn’t happen, I at first panicked, thinking I wasn’t going to get paid at all for my work, only to realize my foolishness when the check came 30 days later.

Again, this is the kind of thing that belongs in the written agreement BEFORE work begins. Typically, this will be something like “NET 30”, meaning that a payment must be made in full within 30 days of the completion of work or date on the invoice. Many projects, especially longer-term ones, will have more complex terms, like payment upon completion of certain portions of work (milestones) or a “half up-front, half upon completion” arrangement. It can vary from project to project, but the important thing is that it gets outlined somewhere in the conversation about a project and is part of the written agreement.

Taxes

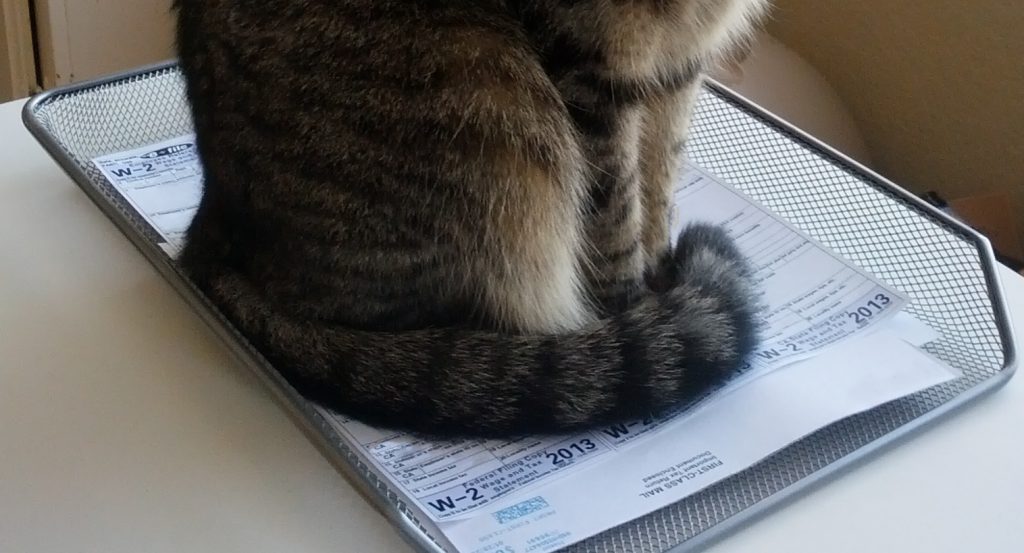

There are few things in my life that I wish I could go back to and do differently; filing my taxes after my first year as a freelancer is one of them. Being a foolhardy recent college graduate and thinking I had it all figured out, I had failed to read up on the tax implications of being your own boss. Suddenly, I was responsible for both the employee AND employer tax contributions, and the checks I would get from clients wouldn’t have any taxes withheld. Having become so used to dealing with Form W2 and the simple tax returns that come with it, I was hilariously unprepared for that tax season, and ended up owing a lot more than I thought I would.

At the recommendation of others, the next year I went to a tax professional to help me with my stack of 1099 forms from my numerous clients. I still consider this to be one of the best decisions I have ever made. Finding a tax person who had a lot of knowledge of the entertainment industry and was used to dealing with freelancers not only saved me the stress of doing it on my own, but also saved me a lot of money. My tax guy helped me set up estimated tax pre-payments, which was essentially like the withholding I was so used to as a W2 employee, and helped me navigate my business expenses to offset my burden. Finding someone who knows what is and is not deductible when you’re dealing with normal and self-employment income tax is a lifesaver, and I cannot recommend it enough. Such a person can also be very helpful if, down the road, you decide to incorporate into a more formal small business.

I’m still learning ways I can be better and more efficient at running my own business. Even though my freelance work has taken a backseat to my day job as of late, I still make use of these hard-learned lessons. Hopefully, my mistakes have inspired you to go read up on things like contracts and tax code in more detail. A little bit of knowledge can save you a lot of time and money in the long term.

Really great points! I learned through an accounting class that it’s standard practice to wait til the last possible day to pay your invoice. You can ask if it’s ok to do “net 15” to get paid faster.

Another tax lesson – I had an accountant steer me early on to spend too much for the wrong reasons. The accountant said to spend more in certain places so that we’d have more deductions, which lowers what you owe in tax. This had two implications: 1. Missing out on retirement contributions. Contributing to a SEP IRA (or solo 401k) will lower your tax liability as much as meals eating out – and will go a lot further. 2. Having lower net income; this can affect your ability to buy a house or car in the future. If you decide to buy a house, the bank looks at how much you earned (after expenses) to determine how much of a loan you will qualify for (how much you can afford to pay). Even though it might help your taxes to buy a bunch of plugins or gear, it might make your earnings look a lot lower than you can actually afford. Only buy what you need – don’t buy just to have lower taxes.

These are very important points! Buying superfluous things simply to offset your tax burden can quickly end up costing more than whatever you “saved”. If you consider the deductions as a way to help offset costs on more expensive items you need to get work done, versus only buying expensive items to increase your tax deductions, you’ll be less likely to fall into this situation. It’s tricky either way.